Battery Industry Trends: Key Insights and Trends from the Volta Foundation

I sat down recently with Yen T. Yeh, Executive Director at the Volta Foundation to dive into their 2023 Battery Report, a 300-page document crafted by specialists across various fields, to summarize and share the most impactful findings.

With 100,000+ downloads each year, The Battery Report is by far the most-read report covering the battery industry.

This year, 120+ battery professionals from 100+ institutions collaborated on this monumental effort to create an open-access, high quality summary of the entire battery ecosystem.

If you don’t have 300-pages worth of time, here’s what you need to know.

Milestones and Emerging Battery Industry Trends

The past year was significant for the global battery industry, with passenger electric vehicle (EV) sales reaching over 10 million units, marking a 32% increase from the previous year, despite rising interest rates.

This growth coincided with a 25% decrease in the average price of new EVs due to competitive pricing among manufacturers. Additionally, lithium costs dropped by 80%, reducing battery cell prices by 16% to just over $100 per kilowatt-hour, bringing EV costs closer to those of traditional vehicles.

Technological and regulatory developments are shaping the industry’s future. Almost all major OEMs have adopted the North American Charging Standard (NACS), promoting uniformity in charging infrastructure. Plans to expand manufacturing capacity by seven terawatt hours by 2030 are underway, with China leading this growth.

The Battery Energy Storage System (BESS) market is rapidly expanding, and innovations in battery chemistries like Lithium Manganese Ferro Phosphate (LAMFP) and sodium ion are driving the industry forward, demonstrating a strong path towards sustainable energy solutions.

Battery Industry Trends and Shifts in Manufacturing and Costs

In 2023, the battery industry continued to reduce cell costs, reversing the unexpected trends observed in 2022. This progress is driven by falling raw material prices, setting a positive outlook for the coming years.

According to Bloomberg New Energy Finance (BNEF), battery costs are expected to drop to $55 per kilowatt-hour for Lithium Iron Phosphate (LFP) and $65 for Nickel Manganese Cobalt (NMC) by 2028, indicating ongoing advancements in affordability for consumers.

The global battery industry is also expanding significantly in Asia, where China has outpaced Western counterparts in manufacturing capacity. By investing strategically since the early 2000s, China is projected to reach a manufacturing capacity of 4.6 terawatt hours by 2030, far exceeding the combined output of the US and Europe.

This scale demonstrates China’s long-term commitment to dominating the battery production landscape. However, North America and Europe are intensifying efforts to scale up their gigafactory infrastructures, despite significant cost disparities.

Enhancing Battery Quality and Addressing Manufacturing Complexities

This is well-known, but can’t be stressed enough: Precise and accurate metrology across all stages of the battery manufacturing value chain is critical.

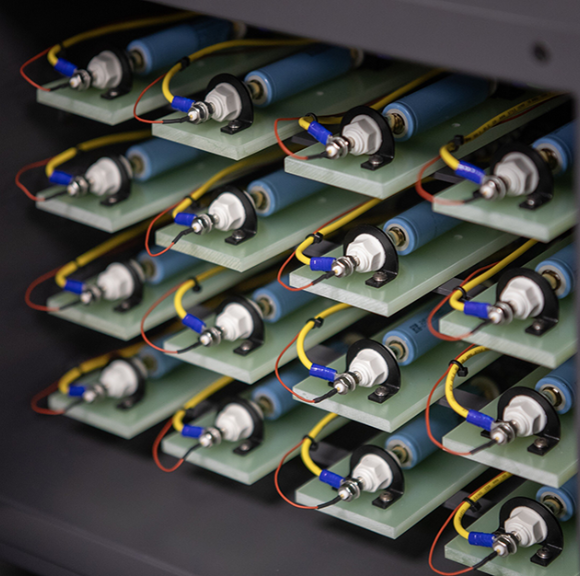

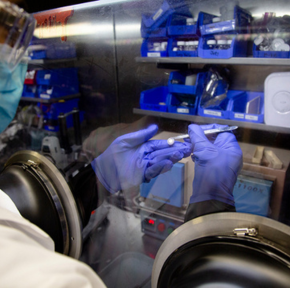

From ultrasound checks for wettability and defects to assessments of welding depth, electrode thickness, and quality, thorough characterization is fundamental to producing high-quality batteries. Batteries require exceptionally precise and accurate components, making the measurement processes crucial for ensuring top-notch end products.

Battery manufacturing demands meticulous attention to detail at every stage, including the electrode production phase, which involves critical processes like mixing, coating, calendaring, slitting, and drying.

This phase is crucial, accounting for nearly 40% of the total cost of manufacturing a battery.

Broadening Battery Applications and Key Growth Trends

Battery technology plays a vital role not just in electric vehicles (EVs) but also across diverse sectors including aerospace, consumer electronics, grid storage, and military applications.

This versatility is underpinned by a wide range of evolving battery chemistries that cater to specific industry needs, showcasing the sector’s capacity for innovation and adaptation.

As the market for EVs expands, driven by their economic and environmental advantages over fossil-fueled vehicles, it’s important to acknowledge these broader applications.

The Battery Energy Storage System (BESS) market is experiencing rapid growth, projected to reach an annual value of $120 to $150 billion by 2030.

Concurrently, the sodium ion battery market is emerging as a promising alternative, undergoing extensive evaluations and advancements.

Solid-state batteries continue to interest automotive OEMs due to their potential to significantly enhance electric vehicle performance. Despite a recent plateau in research publications, sodium ion research remains vigorous, particularly in China, which leads in global output.

Explore Key Battery Industry Trends Deeper

The Volta Foundation’s 2023 Battery Report goes into more detail, but Yen and I pulled out the highlights in our recent webinar with Voltaiq and the Volta Foundation.

Watch the full webinar recording to gain deeper insights and get up to speed with the key battery industry trends. Or download the whole report if you want absolutely everything.

The rapid expansion of the Battery Energy Storage System (BESS) market, along with advancements in sodium ion and solid-state batteries, is paving the way for significant technological progress. China’s comprehensive ecosystem and strategic manufacturing developments underscore the global effort to enhance the battery supply chain and maintain a competitive edge.

As the battery industry continues to grow, the focus on sustainable and efficient energy solutions remains paramount.

Related Posts

The 2023 Battery Report

Decoding the Heartbeat: Unlocking Battery Production Efficiency with Data

Battery Market Trends from China and Beyond: Strategic Insights for Global Industry Challenges

Subscribe to the Building Better Batteries Newsletter.

Written for battery engineers and leaders in the battery industry. Find resources, trends, and insights from some of the world's top battery experts.