The Voltaiq team recently chatted with a VP at one of our transportation OEM customers during a regular customer visit. This VP had worked at Tesla earlier in their career, and told us that their group at Tesla had 100 people working on battery analysis. By contrast, at their present company, Voltaiq gives them a similar capability with just two people.

Stories like this – stories about doing more with less – are more impactful than ever right now. Why? Because the battery sector is facing a serious shortage of battery experts. This is bad news for electrified businesses. It raises the possibility of missed product launches, brand damage, and other ill effects.

Global talent shortages are the worst they’ve been for 15 years, with 7 out of 10 organizations suffering the impacts. According to a Korn Ferry report, the global talent gap will reach 85.2 million workers by 2030, losing businesses trillions of dollars in economic opportunities. Battery manufacturing companies are no exception; in fact, as the epitome of a “knowledge-intensive industry,” they are squarely in the firing line. An EU-funded report points to a sharpening “demand for re-educating battery experts in the educational system as well as scaling-up (vocational) training for technicians.”

And the hard reality here is this: there is no way companies can hire their way out of this problem. There simply aren’t enough battery experts. That is why they have to find another solution to protect their economic futures.

Battery Talent Shortages, East and West

The shortage of battery experts begins at the very start of the supply chain. Most of the world’s batteries are manufactured in Asia. According to Statista’s 2020 report, Korea’s LG and China’s CATL each accounted for just over a quarter of the worldwide lithium battery market, while Japan’s Panasonic supplied just more than 20%.

However, all of these nations – namely South Korea, China, and Japan – are currently facing a shortage of battery experts, which could hamper the global push toward zero-emission transportation infrastructure. According to Reuters, these large Asian corporations are all struggling to fulfill rising demand for research and technical personnel.

Meanwhile, western companies are also feeling the heat. US automakers are spending billions to shift battery cell manufacture back to their home country, in order to meet what is anticipated to be rapidly expanding demand for electric vehicles over the next decade. But they are facing the same pressures. Panasonic, for example, has encountered an acute scarcity of battery experts and battery engineers. The company has had to recruit and retrain non-battery engineers – chiefly chemical engineers – in order to keep their gigafactory in Nevada operating. And even this is a stopgap solution at best: “Demand is far outstripping supply when it comes to chemical engineers with lithium-ion experience,” says Allan Swan, the head of Panasonic’s US battery manufacturing unit based inside the Tesla gigafactory.

In a survey we conducted here at Voltaiq, 4 in 10 respondents mentioned a shortage of battery engineers as a constraint on their development efforts. According to the same report, the top reason (cited by 38 % of respondents) for inefficiencies in existing battery processes is a lack of battery engineers.

These problems are only going to get worse. According to a statement released by Arizona State University, by 2025, America will have a shortage of engineers. Dr. Greg Less, technical director of the University of Michigan Battery Lab, has outlined why we need programs to educate battery experts at all levels. This includes retraining existing workforce, developing community college programs, and providing bachelor’s, master’s, and doctoral degrees.

How Can Companies Fill the Talent Gap?

The good news? There are solutions to the problem that don’t involve hiring engineers that don’t exist. Like other forms of talent shortage, this one can be mitigated with better tools that empower companies to do more with less.

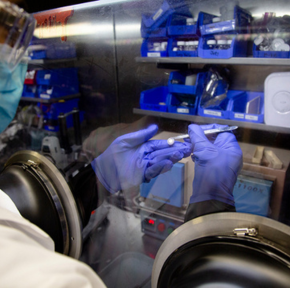

Battery companies need to qualify battery suppliers. They need to conduct the battery analysis necessary to detect problems early and reduce the likelihood of a missed launch. They need to develop confidence that the battery is fully characterized, and won’t have warranty or safety issues. It is these areas that, typically, cause the big slowdowns. However, Enterprise Battery Intelligence enables battery-powered companies to mitigate the shortage of battery experts in a number of ways:

- With an EBI platform in place, a company can hire remote talent, or build a geographically distributed organization that is closer to pockets of talent. Why? Because Voltaiq lets you do a lot of battery work remotely, and makes remote collaboration – even between battery teams on different continents – much easier.

- Recruit more generalized engineering talent (not just ready-made battery experts). Voltaiq automatically pulls a lot of things from the data that you’d otherwise need a battery expert to parse out, and standardizes analysis according to industry best practice. Voltaiq makes it much easier to hire (for example) a mechanical or electrical engineer, and turn them into a battery engineer – just as they’ve been needing to do at the Panasonic-Gigafactory.

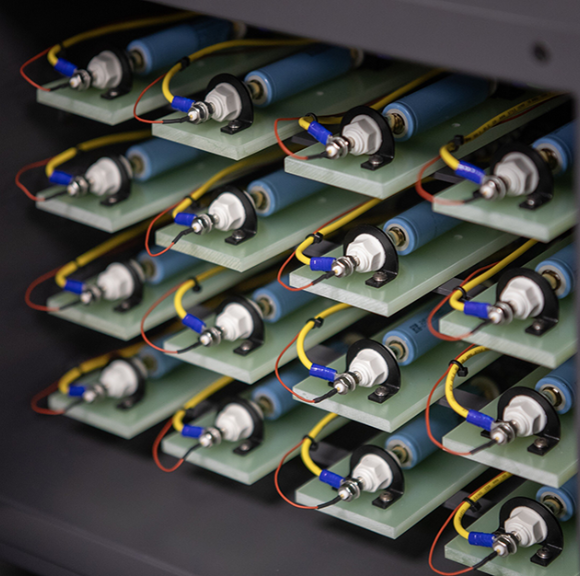

- Scale a battery program faster, with fewer hires. Typically, a single person would have a hard time keeping up with the data coming from 100-200 battery test “channels”. With Voltaiq, a single individual can manage the data from thousands of test channels. As the battery business picks up, a company can double or triple the size of their test lab – without having to double or triple staff.

- Supercharge their existing team by automating over 90% of typical battery analysis tasks. With Voltaiq, all the data aggregation and cleaning is done for you. Shifting from manual to automated here speeds up the actual insight-producing analysis tasks by factors of 20-20,000x.

All of these benefits can be unlocked by the tech of EBI – even if a healthy supply of new battery experts continues to lag market growth.

For example, at one of our customers – a top five global automaker – Voltaiq saves hundreds of hours per program by automating critical analysis tasks. HPPC analysis, in particular, has increased by a factor of 100-1,000x. This saves several hours of work per engineer, per week.

Wanted: Battery Experts

The majority of the battery supply chain begins in Asia, where the world’s largest battery producers are located. Unfortunately, the top three countries, South Korea, China, and Japan, are all experiencing a battery experts shortage. The talent gap is mirrored in the west, and the effects are cascading down through the whole chain of electrified businesses.

The good news is that new tools like Enterprise Battery Intelligence enable battery-powered companies to make better use of the people they currently have, and to be much more productive without hiring.

Supercharge Your Team, And Contact Voltaiq Today!

Related Posts

The 2023 Battery Report

Battery Industry Trends: Key Insights and Trends from the Volta Foundation

Decoding the Heartbeat: Unlocking Battery Production Efficiency with Data

Subscribe to the Building Better Batteries Newsletter.

Written for battery engineers and leaders in the battery industry. Find resources, trends, and insights from some of the world's top battery experts.